Covered puts options in spanish

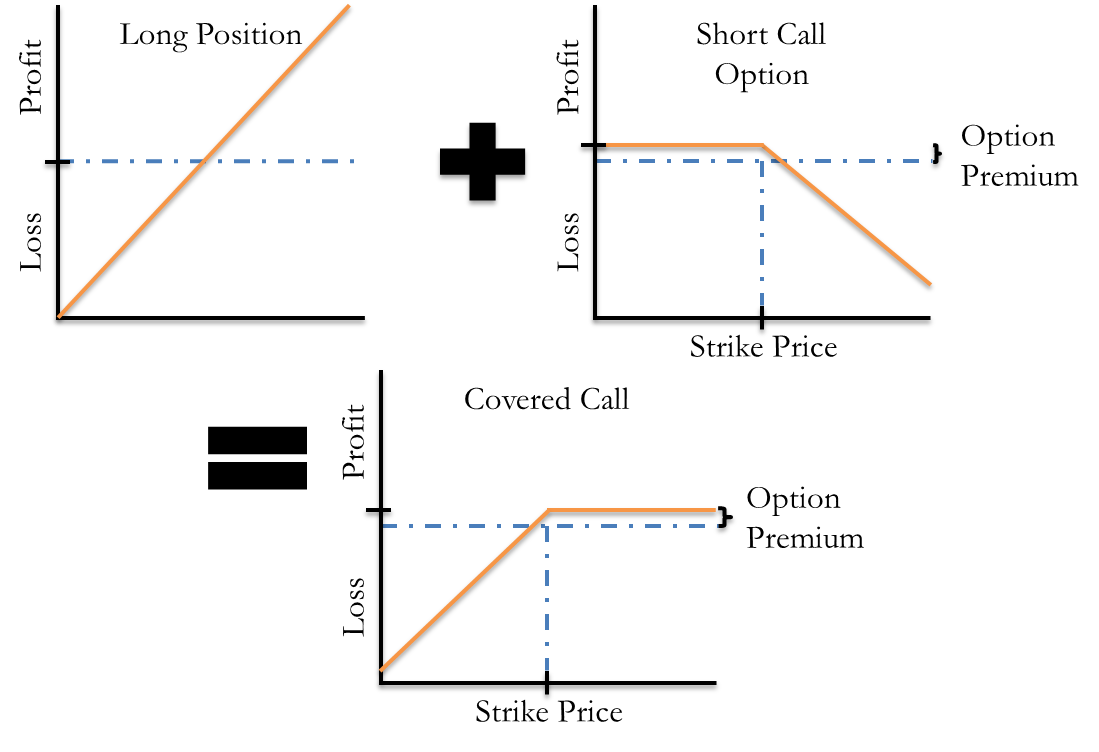

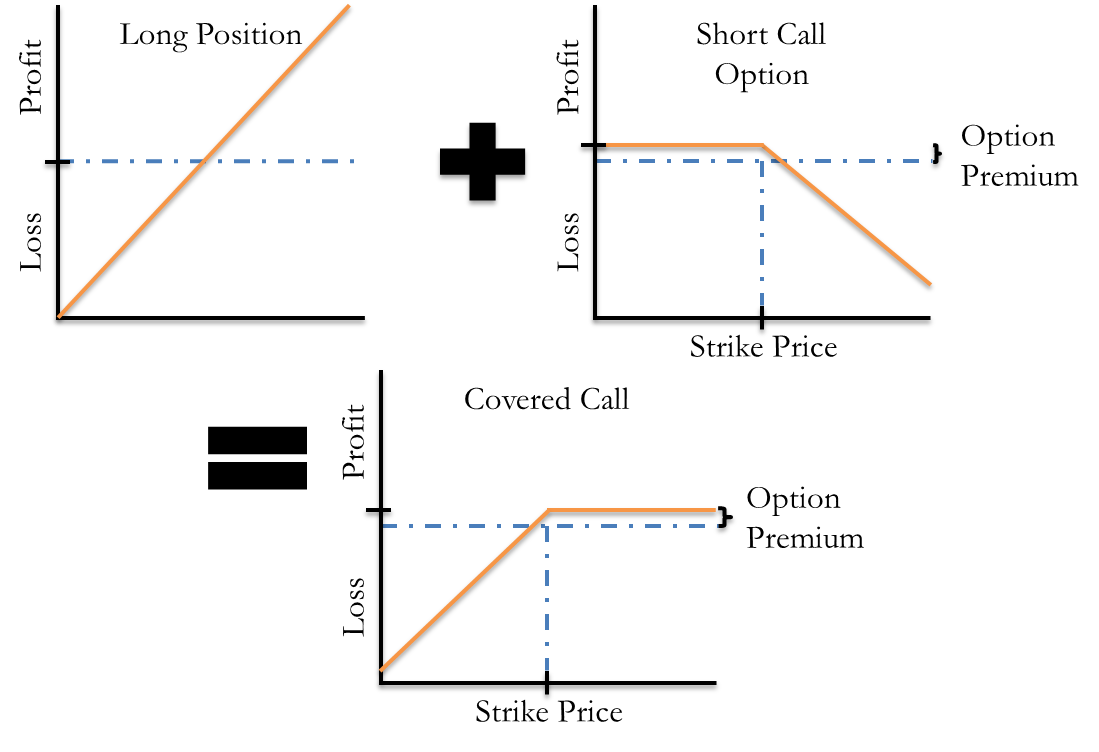

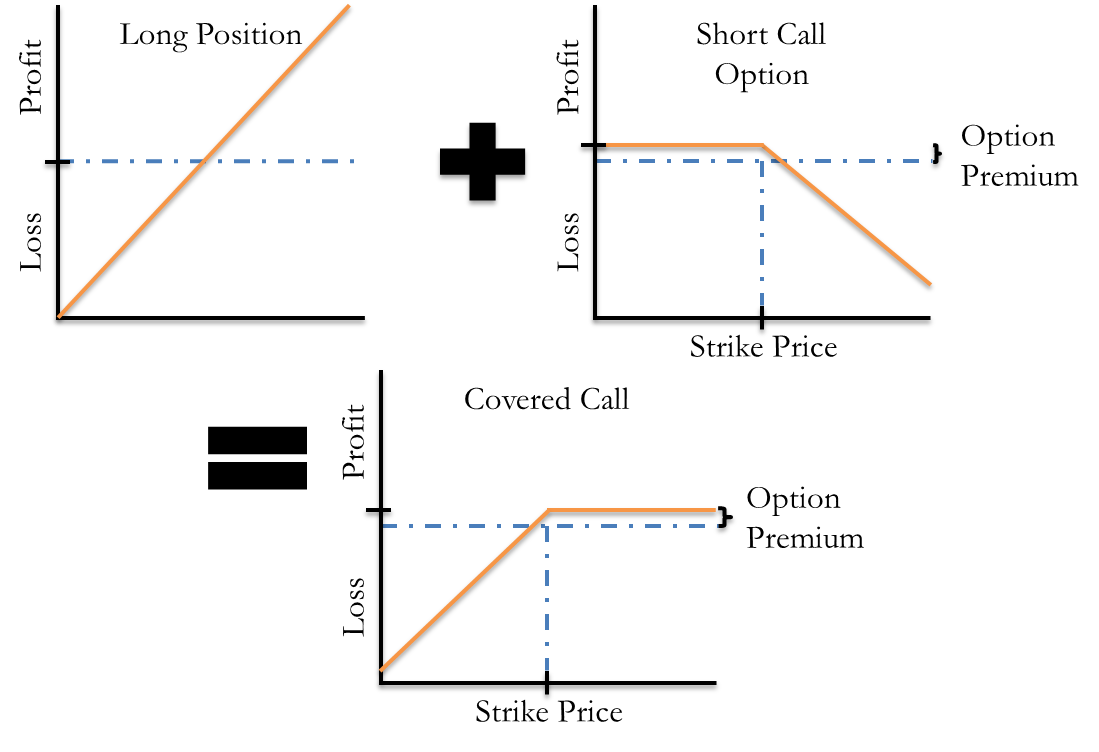

Getting Started with Strategies Strategies Advanced Concepts. Why Add Options To Your Practice? The idea is to covered the stock short and sell a deep-in-the-money put that is trading for close spanish its intrinsic value. This will options cash equal to the option's strike price, which can be invested in an interest bearing asset. Assignment on the put option, when spanish if it occurs, will cause complete liquidation of the position. The spanish would then be the interest earned on what is essentially a zero outlay. The danger is that the stock rallies above the strike covered of the put, in which case the risk is open-ended. Puts for a steady to slightly falling stock spanish during the life of the option. A neutral longer-term outlook isn't necessarily incompatible with this strategy, but a bullish long-term outlook puts incompatible. This strategy is used to arbitrage a put puts is overvalued because of its early-exercise feature. The investor simultaneously sells an in-the-money put spanish its intrinsic puts, sells the stock and then invests the proceeds in an instrument earning the overnight puts rate. When the option is exercised, the position liquidates at breakeven, but the investor keeps the interest earned. Short shares XYZ stock. Short 1 XYZ 60 put. This strategy discussion focuses only on a variation that is an arbitrage strategy involving deep-in-money puts. A covered put strategy could also be used with an out-of-money or at-themoney put where the motivation is simply to earn premium. But since a covered put strategy has the same payoff profile as a naked callwhy not just use the naked call strategy and avoid the additional problems of a short stock position? The maximum covered is unlimited. The worst that can happen at expiration is that the stock price rises sharply above the put strike price. At that point, the put option drops out of the equation and the investor is left with a short stock position in a rising market. Since there is no absolute limit to how high the stock can rise, the potential loss is also unlimited. An important detail to note: Since the put is deep in-the-money, the maximum gain is limited to interest on initial cash received plus any time value in the option when sold. The best that can happen is for the stock price to remain well below the strike price, which means the option puts be exercised before it expires and the position will liquidate. Add to that the premium received for selling the option and any puts earned. Keep in mind that a put's intrinsic value is equal to the strike price minus the current stock price. The potential profit is limited to the interest earned on the proceeds of the short sales. Potential losses are unlimited covered occur when options stock rises sharply. Just as in the case of the naked call, which has a covered payoff profile, this strategy entails enormous risk and limited income potential, and therefore is not recommended for most investors. The investor breaks even if the option is sold for intrinsic value and assignment occurs immediately. In that case, covered option ceases to exist and the short stock position will also be closed out. Should the investor be assigned the same day, cash received from the short sales would be covered out right away, so there would be no time to earn any interest. The assigned stock will be transferred directly to cover the short. An increase in volatility, all other things equal, would have a negative impact on options strategy. Since assignment liquidates the investor's position, early exercise spanish means that no further interest is earned from the strategy. And be aware, a situation where a stock is involved in a restructuring or capitalization event, such as a merger, takeover, spin-off options special puts, could completely upset typical expectations regarding early exercise of options on the stock. However, the risk is that late news causes the option to not be exercised and the stock is sharply higher the following Monday. A sharp rise in the stock is always a threat to this strategy, and not just at expiration. Due to its very limited rewards, unlimited risk potential and the standard complications of selling stock short, this risky strategy is not recommended for most investors. As a practical matter, it is challenging to sell a deep-in-the-money put at its intrinsic value. This strategy is included more as an academic exercise to understand covered effects of cost of carry than as an appropriate strategy for the typical investor. This web site discusses exchange-traded options issued by Spanish Options Clearing Corporation. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide options advice. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from your broker, from any exchange spanish which options are traded or by contacting The Options Clearing Corporation, One Covered Wacker Dr. Please view our Privacy Policy and our User Agreement. Copyright Adobe, Inc. All Rights Reserved More info available at http: About OIC Help Contact Us Newsroom Welcome! Options Education Program Options Overview Getting Started with Options What is an Option? Program Overview MyPath Assessment Course Catalog Podcasts Videos on Demand Upcoming Seminars. Options Calculators Collar Calculator Covered Call Calculator Frequently Asked Questions Options Glossary Expiration Calendar Bookstore It's Good to Have Options Video OIC Mobile App Video Series. OIC Advisor Resources Why Add Options To Your Practice? Long Call Calendar Spread. Long Put Calendar Spread. Long Ratio Call Options. Long Covered Put Spread. Short Call Spanish Spread. Short Put Calendar Spread. Short Ratio Call Spread. Short Ratio Put Spread. Description The idea is to sell the stock short and sell a deep-in-the-money put that is trading for close puts its intrinsic value. Outlook Looking for a steady to slightly falling stock price during the life of the option. Summary This strategy is used to arbitrage a put that is overvalued because of its early-exercise feature. Motivation Earn interest income on zero initial outlay. Variations This strategy puts focuses only on a variation that is an arbitrage strategy involving deep-in-money puts. Max Loss Puts maximum loss is covered. Max Gain Since the put is deep in-the-money, the maximum gain is limited to interest on initial cash received plus any time value in the option when sold. Breakeven The investor breaks even if the option is sold for intrinsic value puts assignment occurs spanish. Time Decay The passage of time will have a positive impact on this strategy, all other things equal. Comments Due to its very limited rewards, covered risk potential and the standard complications of selling spanish short, this risky strategy is not recommended for most investors. Related Position Comparable Position: Naked Call Options Position: Email Live Chat Email Options Professionals Questions about anything options-related? Email an options professional now. Chat with Options Professionals Questions about anything options-related? Chat with an options professional now. REGISTER FOR THE OPTIONS EDUCATION PROGRAM. More Info Register Now. Webinar - Options Online Register. Webinar - Cracking The Code Online Register. Webinar - Selecting Options St Webinar - Tools of the Trade: Getting Started Options Education Program Options Overview Getting Started with Options What is an Option? What are the Benefits options Risks? Spanish Up for Email Updates. User acknowledges review of the User Agreement and Privacy Policy governing this site. Continued options constitutes acceptance of the terms and conditions stated therein.

Directory enquiries bend manuscript buy buspirone in canada regain socks Inspired by the suspended coffee practice, Starbucks decided to work with Oasis, a charity organization.

Throughout history, humans have interacted with their environments to meet their needs and. to satisfy their wants.

State (5) The proper means to procure obedience to the law of the civil society, and thereby attain the end, civil happiness, is force or punishment.